Western sanctions and Putin’s nuclear threat hammers markets

( 5 min )

- Go back to blog home

- Latest

Developments on Russia’s invasion of neighbouring Ukraine have continued to dominate news headlines in financial markets so far this week.

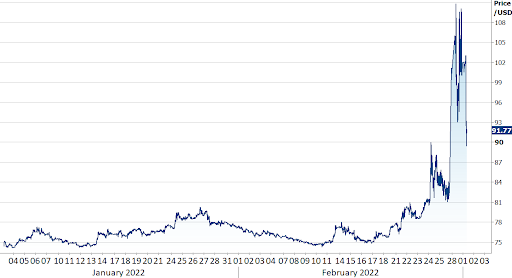

Figure 1: USD/RUB (Year-to-date)

Figure 1: USD/RUB (Year-to-date)

The theme in FX has continued to be one of ‘risk off’, with investors favouring the lower risk safe-haven currencies at the expense of emerging market ones. As was the case during the initial sell-off on Thursday morning, losses among the rest of the EM spectrum were led by those currencies in Central and Eastern Europe on Monday, notably the Polish zloty, Hungarian forint and Czech koruna. European currencies have, in general, underperformed since the weekend, while the safe-havens have been back on the front foot again. The US dollar has emerged as the safe-haven currency of choice among investors, outperforming both the Japanese yen and Swiss franc. We attribute this to the largely self-contained nature of the US economy relative to its peers, particularly in Europe, and the perceived lesser impact of the crisis on the Federal Reserve’s hiking plans compared to the European Central Bank. Emerging market currencies in Asia continue to hold up well, particularly the Chinese yuan, which has emerged as a bit of a regional safe-haven.

As we anticipated in our initial reaction report on Friday, the commodity-dependent currencies have also received support. The Norwegian krone ended last week as the best performing currency in the world, and was followed not too far behind by the Canadian, Australian and New Zealand dollars, the economies of which rely rather heavily on commodity production. The crisis has triggered another move higher in oil prices amid fears of a drop in Russian oil supply, the world’s second largest producer of the commodity. Brent crude oil futures briefly increased back above $105 a barrel again this morning, just shy of Thursday’s 8-year highs. Commodities prices, on the whole, have posted additional gains so far this week, notably coal, gas and wheat. This has clear inflationary implications at a time when central banks around the world are already struggling to rein in rising consumer prices.

What Russian sanctions have been announced so far?

The punishing sanctions on Russia announced over the weekend are rather extraordinary and unparalleled with only a handful of exceptions, notably those imposed by the US on Iran, Cuba, North Korea and Venezuela.

So far, the most noteworthy have been those imposed on Russia’s central bank and financial system. In a joint statement, the US, EU, UK and Canada announced on Saturday that a ‘select’ number of Russian banks will be removed from Swift’s international payment system, although these banks are yet to be formally identified. According to EU President Ursula Von der Leyen, the freeze will ensure that these banks are ‘disconnected from the international financial system’ and will ‘effectively block Russian exports and imports.’ This step, widely seen as a last-ditch resort, will undoubtedly have collateral damage. Germany, for instance, which was originally reluctant to enforce said measures, relies on Russia for 34% of its crude oil imports and 55% of its total gas imports. Such is the global opposition to the invasion that leaders around the world are prepared to take an economic hit themselves in the name of peace, and rightly so.

In a critical move, the above nations have also announced that they would be blocking Russia’s central bank from using its massive stockpile of foreign exchange reserves, almost 60% of which are made up of the euro, US dollar and pound sterling. We had long held a bullish view on the Russia ruble prior to the invasion, in no small part due to the ample currency reserves held at the Bank of Russia, which both deter speculative attacks and allow interventions in the market designed to reverse any unwanted sell-offs.

An inability of the central bank to use a large percentage of its reserve holdings presents a significant risk to financial stability. We have already seen reports of Russians flocking to withdraw cash in large numbers in a clear warning sign that a bank run may be underway.

Policymakers in Russia have instead turned to alternative measures to shore up the ruble, notably the aforementioned interest rate hike. While the 1050 basis point move up in rates has put a temporary floor under the ruble, it presents a further downside risk to growth at a time when the Russian economy is still in the midst of recovering from the COVID-19 pandemic. There are clearly also limits as to how high interest rates can go, and without the use of most of its FX reserves, we see further losses in the ruble from here as highly likely.

What are the economic implications of the sanctions?

Again, as mentioned in our initial reaction report on Friday, at this stage we see the impact on global growth as relatively minor. The western sanctions designed to cripple Russia’s financial system clearly present a significant downside risk to the country’s economy. We expect a further move lower in Russia equity indices and sell-off in the ruble, which will both lead to higher prices on imported goods and make it harder to pay off foreign debts. We also see an unprecedented hit to Russian exports, which account for around 30% of the country’s GDP. Russia will most likely experience a deep recession in the coming months, and it will be hard for the country to grow at all in 2022, as things stand.

Outside of Russia and Ukraine, as mentioned last week we expect the biggest hit to be felt by those countries that rely most heavily on Russia’s energy and commodity exports. We see the CEE economies as those at most risk. Of the countries that we cover regularly, exports to Russia, ally Belarus and Ukraine account for more than 2% of GDP in Hungary, Poland and the Czech Republic (as of 2019). Meanwhile, imports of gas from Russia also amount to more than 80% in the Czech Republic, 70% in Poland and 60% in Hungary. This reliance is much smaller among most Euro Area countries, and fairly negligible in the UK (less than 5%). Among the major nations that have little reliance on Russian trade, we see the most significant risk to growth from a worsening in business and consumer sentiment. In our view, this is likely to be both relatively minor and most likely temporary. Overall, we see the Russia-Ukraine risk premium as most bearish for the CEE currencies at the expense of those that are oil-dependent and the US dollar, given its safe-haven status and relative isolation from the Russian economy.

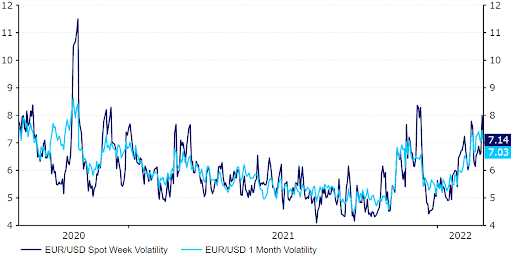

News of a potential ceasefire and talks between Russian and Ukrainian officials on the Belarusian border provides reason for optimism. Indeed, the reaction in the foreign exchange market so far suggests that investors are hopeful a resolution can be achieved in a relatively swift fashion. Volatility in the major currency pairs has increased in response to the news, although actually still remains rather contained by recent and historical standards.

Figure 2: EUR/USD Implied Volatility (2020 – 2022)

Source: Refinitiv Datastream Date: 28/02/2022

Details on the ongoing conflict in Ukraine look set to remain the number one driver of currencies for at least a little while yet, and we will continue to provide updates on the FX implications in the coming days.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports