Russian invasion of Ukraine upends world markets

( 5 min )

- Go back to blog home

- Latest

In the end, US intelligence warnings were fully vindicated as Putin launched a full-scale invasion of Ukraine on Thursday.

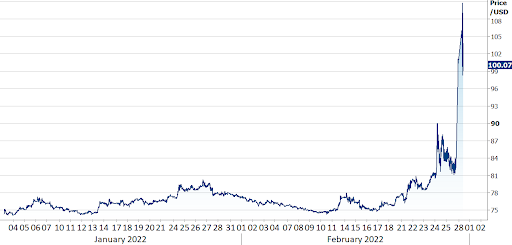

Figure 1: USD/RUB (YTD)

Source: Refinitiv Date: 28/02/2022

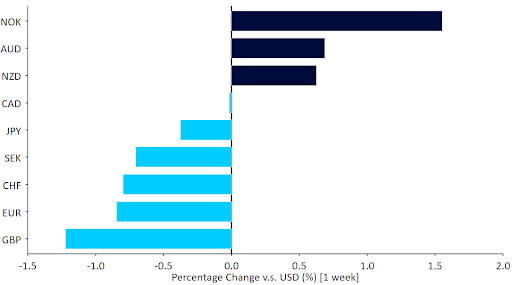

Two themes could be discerned from last week. First, the US dollar is back as the safe-haven of choice among investors. The Swiss franc and the Japanese yen outperformed, albeit to a much lesser extent. Second, commodities rallied, led by the energy complex, as did the currencies of commodity exporting countries, with the obvious exception of the ruble. The Norwegian krone rose sharply against almost every other currency in the world.

Currency markets now will be driven by the developments out of Ukraine and Russia, but also the reaction of the world’s central bank to the crisis, which will likely exacerbate inflationary pressures while also adding downside economic risks, particularly in Europe. The outlook is extremely uncertain, but we will do our level best to keep you posted on key developments.

Figure 1: G10 FX Performance Tracker (1 week)

Source: Refinitiv Datastream Date: 28/02/2022

GBP

Sterling had a particularly difficult week, falling sharply against every other G10 currency. The pound briefly fell below the 1.33 level on the dollar on Thursday, although it has at least stabilised following the sell-off. In addition to the flight from risk, Bank of England officials tried to downplay the importance of the four MPC votes in favour of a 25 basis point hike at its last meeting. Financial markets continue to fully price in a hike at the BoE’s next policy meeting in March, although investors now see little to no chance of a 50 basis point move in rates.

Not much news on tap this week, which means sterling will trade mostly in line with risk assets, which is to say, geopolitical developments.

EUR

The key question for the euro now becomes the extent to which the ECB delays tightening in response to war in Ukraine. The harsher sanctions announced over the weekend increase the risk of disruption of Russian energy supplies to Europe, which will be both inflationary and detrimental to production capacity across the economy, a nasty mix the response to which is not immediately obvious.

Ordinarily the February inflation data out Wednesday would dominate the week, but obviously the developments in Russia and Ukraine and the reaction from ECB officials will be far more important this week.

USD

The US is a relatively self contained economy and not dependent on Russia for energy supplies. It is, therefore, likely to wear any long-term economic fallout from the Ukraine war and the draconian sanctions announced by the West relatively better, and hence is not surprised that the dollar is the safe-haven of choice among the major currencies. Last week we had yet another upward inflation surprise, this time in the PCE number.

This week’s nonfarm payrolls number is shaping up to be very strong as well, with sharp wage pressures. As in the case of the ECB, there remains considerable doubt as to whether the Fed can really afford to delay the removal of accommodation in the face of yet another inflationary shock. Chair Powell testimony to Congress on Wednesday and Thursday should provide some clarity here, and we regard it as the key event of the week, in addition of course to the developments around the Russian invasion of Ukraine.

CHF

The Swiss franc initially jumped on the news of the Russian invasion of Ukraine due to its safe-haven status, although it ended the week roughly in the middle of the G10 dashboard, underperforming the commodity currencies, the Swedish krona and the US dollar. Still, on Thursday, EUR/CHF fell below the 1.03 mark to its lowest level since 2015, and the Swiss currency remains one of the strongest in Europe.

News that Switzerland is considering the adoption of EU sanctions and is likely to freeze Russian assets was quite surprising considering the country’s historical neutrality. This both adds to the gravitas of the situation, and further strengthens the West’s response to Russian aggression. While the Swiss economic calendar this week is quite rich, and includes February CPI inflation data (out on Thursday), we’ll continue to focus primarily on the Russia-Ukraine conflict. Should risk sentiment continue to deteriorate further, we may see an additional strengthening of the Swiss currency.

AUD

The Australian dollar fell below the 0.71 level versus the dollar on Thursday, following the news of the start of the Russian invasion of Ukraine. AUD was kept from further losses by the rally in commodity prices, given the country’s status as a net energy exporter.

In domestic economic news, the Australian composite PMI rose to an 8-month high of 55.9 in February from 46.7 in January, due to the easing of the omicron wave. This expansion was mainly due to a robust performance in services, with the services sector expanding to an 8-month high (56.4 versus 46.6 in January). Manufacturing growth also advanced to a two-month high (57.6 vs 55.1).

The Reserve Bank of Australia is set to meet on Tuesday, although it is widely expected to keep interest rates unchanged. In addition, fourth-quarter GDP will be released on Wednesday. Even so, we think that the main driver of the currency will be the situation in Ukraine.

CAD

The Canadian dollar weakened in line with its major peers last week, falling to its lowest in nearly two months amid the flight to safety after Russia’s attack on Ukraine. The downside trend of CAD was capped by the increase in oil prices. Brent crude oil, a major Canadian export, breaching the $100 mark for the first time since 2014 amid concerns over a drop in Russia oil supply.

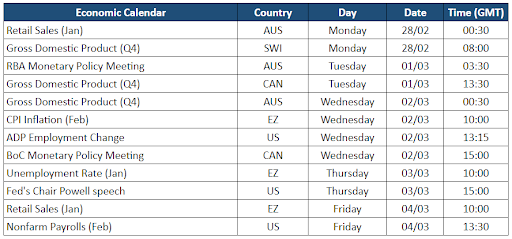

Figure 3: Brent Crude Oil Futures (YTD)

Source: Refinitiv Datastream Date: 28/02/2022

The Bank of Canada is set to meet on Wednesday with ourselves, and indeed the market, expecting a 25 basis point increase in interest rates, despite the near-term geopolitical uncertainty. The latest inflation reading showed that price growth climbed to a 30-year high 5.1% in January, adding more pressure on the BoC to hike interest rates during its monetary policy meeting. Before the meeting, fourth-quarter GDP will be released on Tuesday. Still, similar to all the other currencies, CAD will be mostly driven by events in Ukraine.

CNY

So far, the Chinese yuan has been one of a few EM currencies little affected by Russia’s invasion of Ukraine. It was also one of a handful of currencies that ended the week higher against the US dollar, with USD/CNY falling to its lowest level since April 2018.

Overall, the Asian currencies were among the least affected, which isn’t surprising, considering the large geographical proximity from the conflict area and limited risk to their economies. Nevertheless, there’s speculation we could see some weakness in the yuan if Russia’s central bank starts dumping its yuan-nominated assets in a bid to defend the ruble. Renminbi assets made up 13.1% of the Bank of Russia’s FX and gold assets as of June 2021, with the yuan being the third most important currency in those reserves. China was also #1 in terms of the geographical distribution of those assets (excluding monetary gold). Despite the above, we don’t see the Russia-Ukraine war as a particularly significant risk to the currency. In fact, the yuan’s appeal could improve as a result of the conflict.

In addition to any headlines regarding the Russia-Ukraine conflict, this week we’ll focus on China’s economic data including both the Caixin and official PMI numbers for February (out Tuesday and Thursday).

Economic Calendar (28/02/2022 – 04/03/2022)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports