FOMC July Meeting Reaction: US dollar slides after Powell calms rate hike expectations

( 3 min. )

- Go back to blog home

- Latest

Wednesday’s FOMC meeting was greeted with a bout of weakness in the US dollar, with the greenback trading lower against just about every other major currency.

The Fed’s slightly less pessimistic view on the pandemic and its impact on the US economy was hawkish, although investors sold the dollar on the lack of clarity surrounding the bank’s timetable for tapering its asset purchase programme. Going into the meeting, markets were keeping a close eye on the bank’s communications for any hint that a tapering could be on the horizon. Powell stated that the bank had taken the first ‘deep-dive’ into how to scale back purchases, although no decision had been made regarding its timing. Perhaps more importantly for markets, he also stressed that the bank was still a ways away from considering raising interest rates. This is a slight contrast in tone from the June meeting, which saw a sharp upward revision to the bank’s interest rate projections.

It was Powell’s comments on interest rate that the market perhaps latched onto the most, with investors sending the dollar back towards the 1.19 level versus the euro and its weakest position in trade-weighted terms since the end of June. As we anticipated, with covid uncertainties lingering in the background, we think that policymakers in the US will not necessarily rush into normalising monetary policy. We now see it as less likely that we’ll get a hint that tapering could be on the way at the August Jackson Hole conference. We may instead have to wait until the September FOMC meeting for a signal as to the timing of QE tapering. At this point, the Fed should have a much clearer idea as to the state of the health crisis and the nature of the recent spike in US inflation.

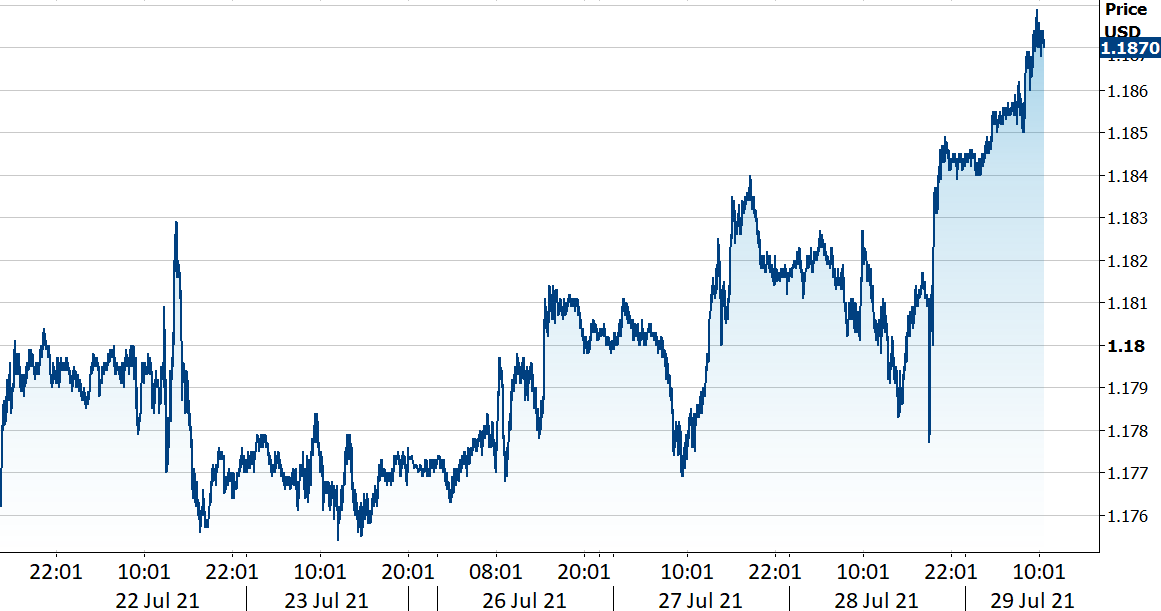

Figure 1: EUR/USD (22/07/21 – 29/07/21)

Source: Refinitiv Datastream Date: 29/07/2021

Until then, however, the dimming prospect of US rate hikes any time soon and the continued rollout of vaccines around the world may weigh on the dollar in the near-term, given that improved risk appetite tends to be followed by a weaker greenback.